Hedge funds are a type of investment vehicle that has long been shrouded in mystery and intrigue. Often associated with high-risk, high-reward strategies, they are not typically available to the average investor. But as more and more people seek ways to diversify their portfolios and potentially increase their returns, the question arises: should you invest in a hedge fund?

In this blog post, we’ll demystify hedge funds and explore the pros and cons of investing in them. We’ll cover what a hedge fund is, how it works, and the types of strategies they employ. We’ll also discuss the potential benefits of investing in a hedge fund, such as the ability to generate higher returns and diversify your portfolio.

However, we will also discuss the risks and downsides of investing in a hedge fund, including the high fees, lack of transparency, and potential for significant losses. It’s important to have a clear understanding of these risks before making any investment decisions.

Ultimately, whether or not you should invest in a hedge fund depends on your personal financial situation, investment goals, and risk tolerance. By the end of this post, you’ll have a better understanding of what hedge funds are and whether they are a suitable investment option for you.

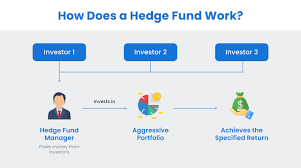

How do hedge funds work?